Create a Payment Link with the API

This guide is about creating a payment link automatically with our API

You can also create payment links from the dashboard. See the guide page here

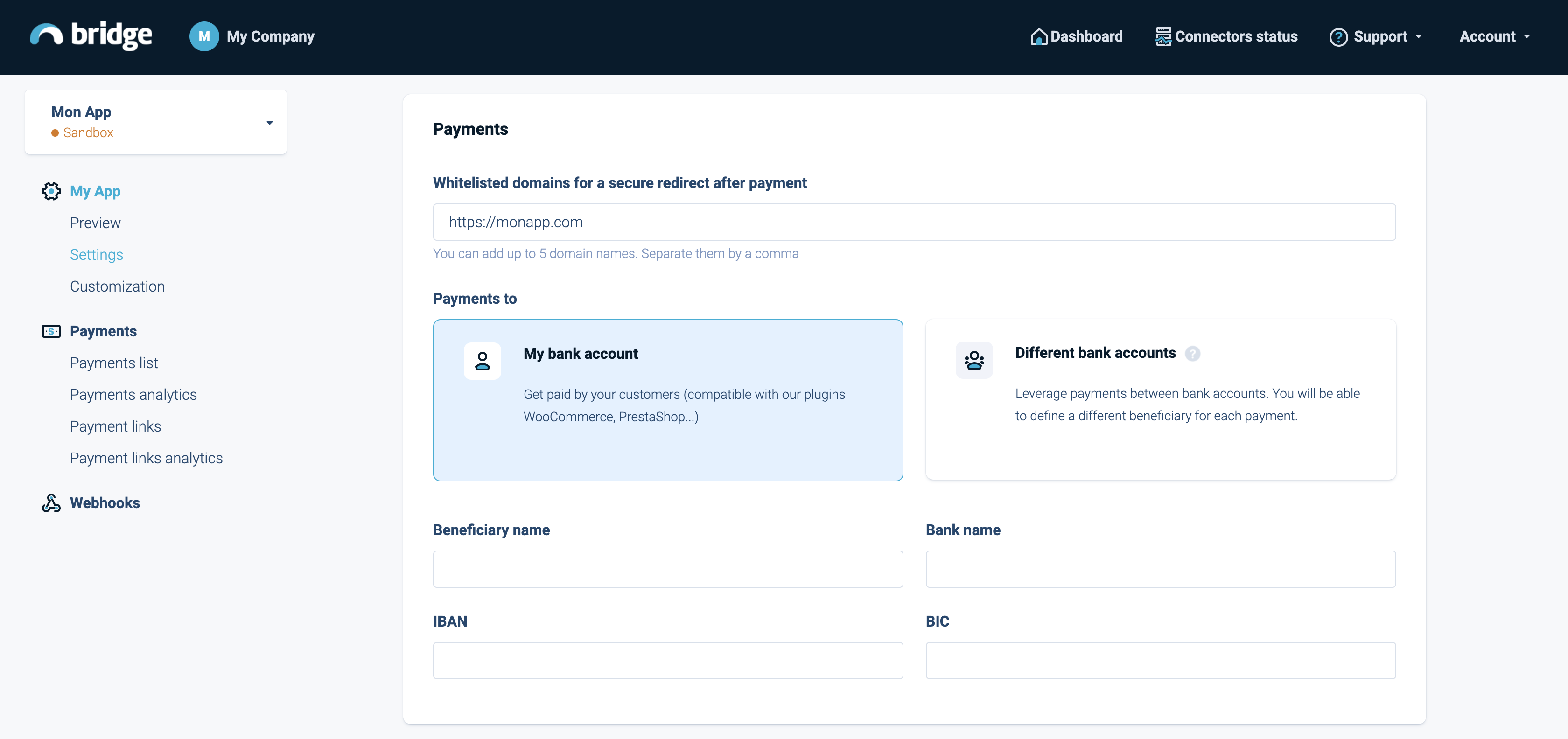

Before creating a Payment Link, you need to configure the Payment settings on our dashboard.

Depending on your use case:

- Active

Payments to my bank accountif every payment should be sent to the same beneficiary - Active

Payments to different bank accountsif you want to define a different beneficiary for every payment

For the first use case, complete the beneficiary's details:

Beneficiary nameBank nameIBANBIC

Whitelisted domain for callback URLs enables you to redirect the payer after confirming the payment in our funnel.

Note: if your application is in production, you need to be an administrator to edit the payments settings

Payment settings

Then you can use our API to generate Payment Links. Please read Create a payment link's endpoint document to see the details.

The required fields are:

amountandcurrencyexpired_date: the maximum duration is 90 dayslabel: description displayed on the bank interface of the customeruser: (first_nameANDlast_name) ORcompany_nameof the user who will use the Payment Link

And you can also defined:

end_to_end_id(optional) : id that will be sent to the bankbeneficiary(optional): information about the payment beneficiary -> (first_nameANDlast_name) ORcompany_nameandibanclient_reference: a reference you can set to retrieve the payments between your system and ourscallback_url(optional) : a url where the payer will be redirected after confirming the payment.

If you don't define a beneficiary in this call, the payment will be sent to the default beneficiary you configured in the dashboard.

Body example:

curl 'https://api.bridgeapi.io/v2/payment-links' \

-X POST \

-H 'Bridge-Version: 2021-06-01' \

-H 'Content-Type: application/json' \

-H 'Client-Id: MY_CLIENT_ID' \

-H 'Client-Secret: MY_CLIENT_SECRET' \

-d $'{

"user": {

"first_name": "Thomas",

"last_name": "Pichet",

"external_reference": "REF-USER-1234_AZ"

},

"expired_date": "2021-07-24T22:00:00.000Z",

"client_reference": "ABCDE_FG-HI_12345",

"transactions": [

{

"amount": 120.98,

"currency": "EUR",

"label": "Refund 123456",

"beneficiary": {

"first_name": "Test",

"last_name": "Merchant",

"iban": "FR2310096000301695931368H67"

},

"end_to_end_id": "E2E_ID-1234"

}

]

}'

Response example

{

"url": "https://pay.bridgeapi.io/link/9dcf522ce3663efc598f573634531eb3fccbbcdde0bc5d674c95c0740feb0ec6",

"id": "3ae3a3d6-f9d5-445e-b8fe-2db1ab8c39d8"

}

Once you have created payment links, you can see them in your dashboard and you can also list them with API thanks to the List payment links endpoint.

When your customer tries to initiate his payment, a payment request will be created.

We recommend integrating our Webhooks events to be updated on payment links statuses and on relative payment transactions.

For more details about the

payment requests, please check the Payments Initiation guide.

Updated about 2 years ago