Create your first payment link from the API

Our API allows you to effortlessly create payment links for your online store or bill collection. Here's how it works:

Payment link creation

When you create a payment link with the Payment links endpoint, the required fields are:

amount: Specify the payment amountcurrency: Choose the currencylabel: Description displayed on the bank interface of the customer. If not provided, it will default to "Bridge Payment dd-mm"user: Identify the payer with (first_nameANDlast_name) ORcompany_nameend_to_end_id: Assign an id that will be sent to the bankclient_reference: a reference you can set to retrieve the payments between your system and ours for easy tracking

Depending on your usecase, you can also define two more values that impact the user experience: expired_date, execution_date and callback_url.

In the following sections, let's dig into these use cases.

It is also possible to do Bulk Payment Links by multiplying the transaction object in the body of the call create a payment link.

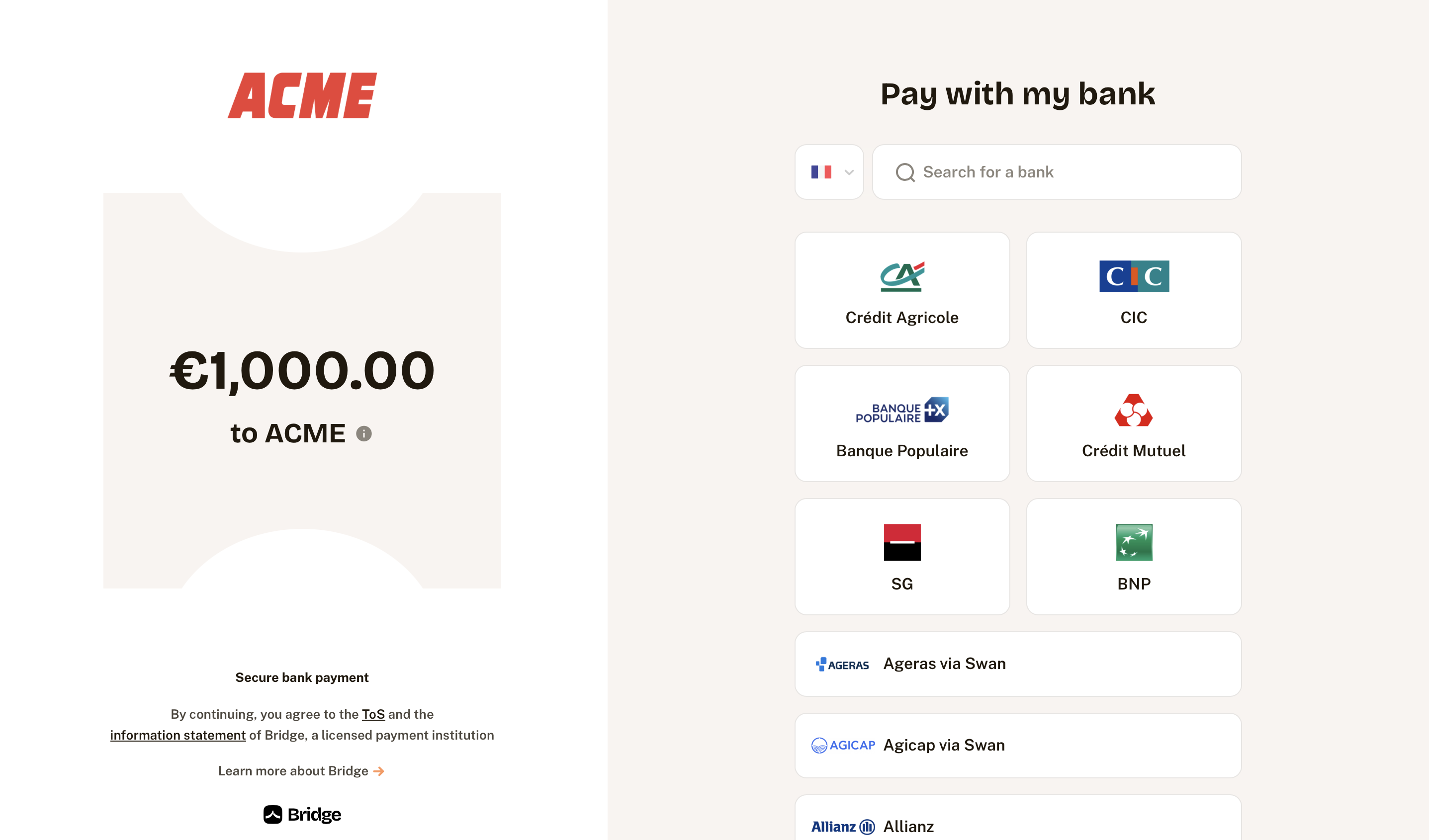

Checkout

- To redirect customers to your website after payment, add a

callback_urlto your request - For checkout experience, no need to set the

expired_date. Payment links are active for 15 minutes by defalut ensuring a hassle-free process.

When setting a callback_url, after payment confirmation your user will be redirected to this url with the parameters below:

payment_link_idpayment_request_idstatuswith the valuesuccess

If your user clicks on the exit cross, you will receive the callback with the parameters below

payment_link_idstatuswith the valueabortstepwhich could bebanks_list,parent_bank_pageorbank_page

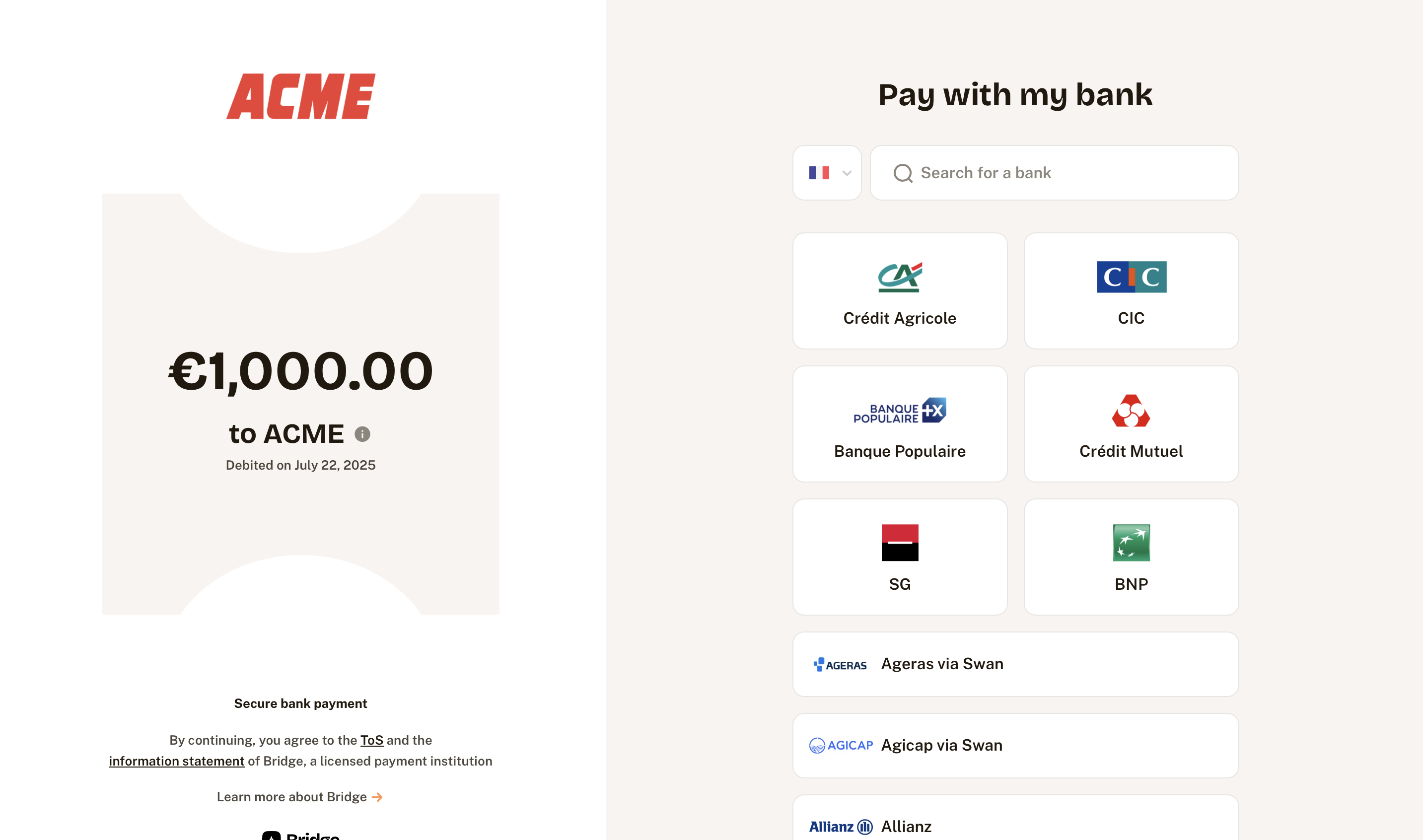

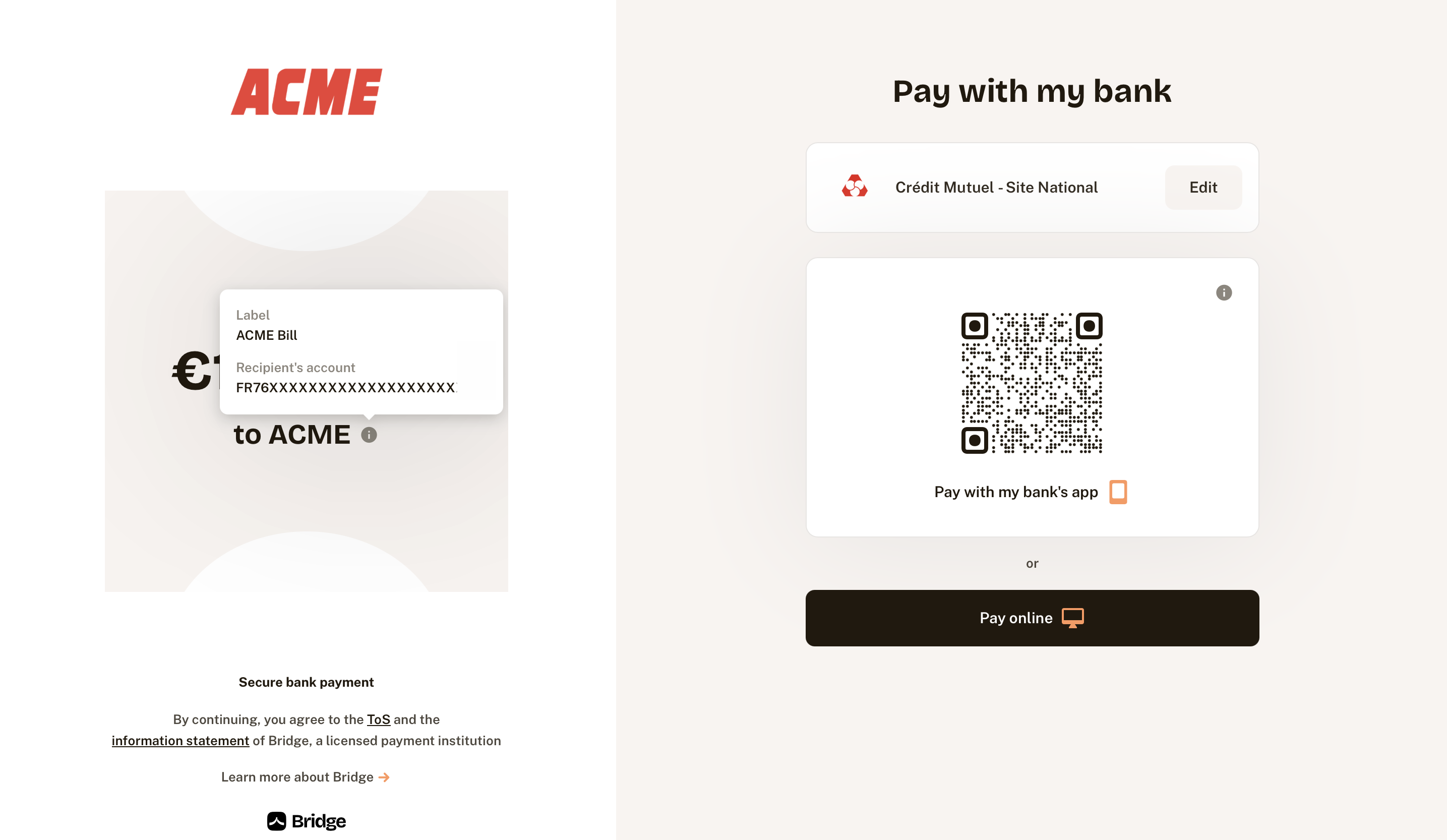

Pay by Link

- Don't send any

callback URL: Customers remain on our website to view their payment results. - Add an

expired date: You can choose how long the link remains active (up to 90 days), and users will be informed of the expiration date. - You can also enable delayed payment. Add an

execution_dateon the transaction object. For banks that do not support the deferred payment, the user will be notified and the payment will be initiated normally.

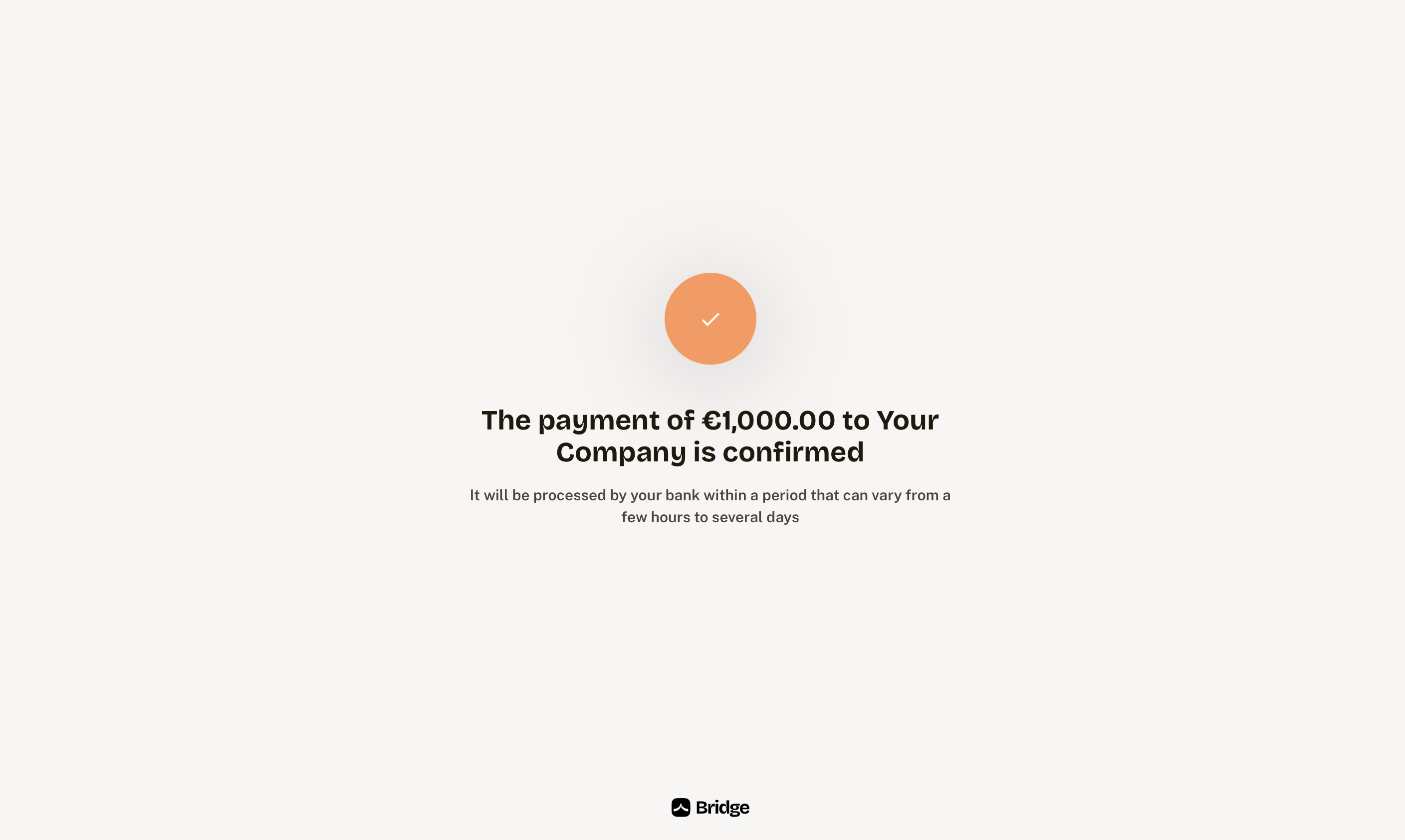

Whencallback_url is not provided, your user will see the payment's status directly on our interface.

You can find below two body examples for these use cases:

curl 'https://api.bridgeapi.io/v3/payment/payment-links' \

-X POST \

-H 'Bridge-Version: BRIDGE_VERSION' \

-H 'Content-Type: application/json' \

-H 'Client-Id: MY_CLIENT_ID' \

-H 'Client-Secret: MY_CLIENT_SECRET' \

-d $'{

"user": {

"first_name": "Thomas",

"last_name": "Pichet",

"external_reference": "REF-USER-1234_AZ"

},

"callback_url": "https://myshop.com",

"client_reference": "ABCDE_FG-HI_12345",

"transactions": [

{

"amount": 120.98,

"currency": "EUR",

"label": "Refund 123456",

"end_to_end_id": "E2E_ID-1234"

}

]

}'curl 'https://api.bridgeapi.io/v3/payment/payment-links' \

-X POST \

-H 'Bridge-Version: BRIDGE_VERSION' \

-H 'Content-Type: application/json' \

-H 'Client-Id: MY_CLIENT_ID' \

-H 'Client-Secret: MY_CLIENT_SECRET' \

-d $'{

"user": {

"first_name": "Thomas",

"last_name": "Pichet",

"external_reference": "REF-USER-1234_AZ"

},

"expired_date": "2023-01-24T22:00:00.000Z",

"client_reference": "ABCDE_FG-HI_12345",

"transactions": [

{

"amount": 120.98,

"currency": "EUR",

"label": "Refund 123456",

"end_to_end_id": "E2E_ID-1234"

}

]

}'{

"url": "https://pay.bridgeapi.io/link/9dcf522ce3663efc598f573634531eb3fccbbcdde0bc5d674c95c0740feb0ec6",

"id": "3ae3a3d6-f9d5-445e-b8fe-2db1ab8c39d8"

}Payment lifecycle

Once you have created payment links, you can see them in your dashboard and you can also list them with our API, thanks to the List payment links endpoint.

Ensure that your integration is robust and your payment tracking is reliable by:

- Managing Payments statuses to know when your payment is rejected or executed

- Integrating our Payments webhooks to be updated on

payment transactions - Testing your payment flow with our Demo Bank

Updated 3 months ago