Account types and user experiences

Depending on your needs, your project may require fetching either all accounts or only payment accounts, offering two distinct experiences for your users

When integrating our API, you can customize the account retrieval process based on your specific needs. Whether you require access to all accounts or just payment accounts, we provide distinct options to optimize the experience for your users.

- Payment Accounts: Focuses exclusively on accounts used for payments (e.g., checking accounts and cards). This mode simplifies the banking connection lifecycle and provides a streamlined experience for users.

- All Accounts: Grants access to the full range of user accounts, including checking, cards, savings, loans, and investment accounts (e.g., stocks).

Payment accounts (default mode)

If you create a Connect session without specifying the account_types parameter, payment accounts will be used by default.

In this mode:

- Users benefit from a seamless redirected experience, which opens their bank's mobile app

- Authentication is quick and secure, often using biometrics, allowing users to grant us access to their banking data with minimal effort

This approach ensures an optimal user experience and maximizes conversion rates.

All accounts

This mode is more complex and recommended only for specific use cases

To enable this mode, set the account_types parameter to all when creating a Connect session.

In this mode:

- Users first go through a redirected experience similar to the payment accounts flow (cf. previous section)

- They are then prompted to connect additional accounts by securely entering their banking credentials in the Connect.

This multi-step process enhances banking data coverage but requires more effort from users and involves a more complex lifecycle for managing banking connections

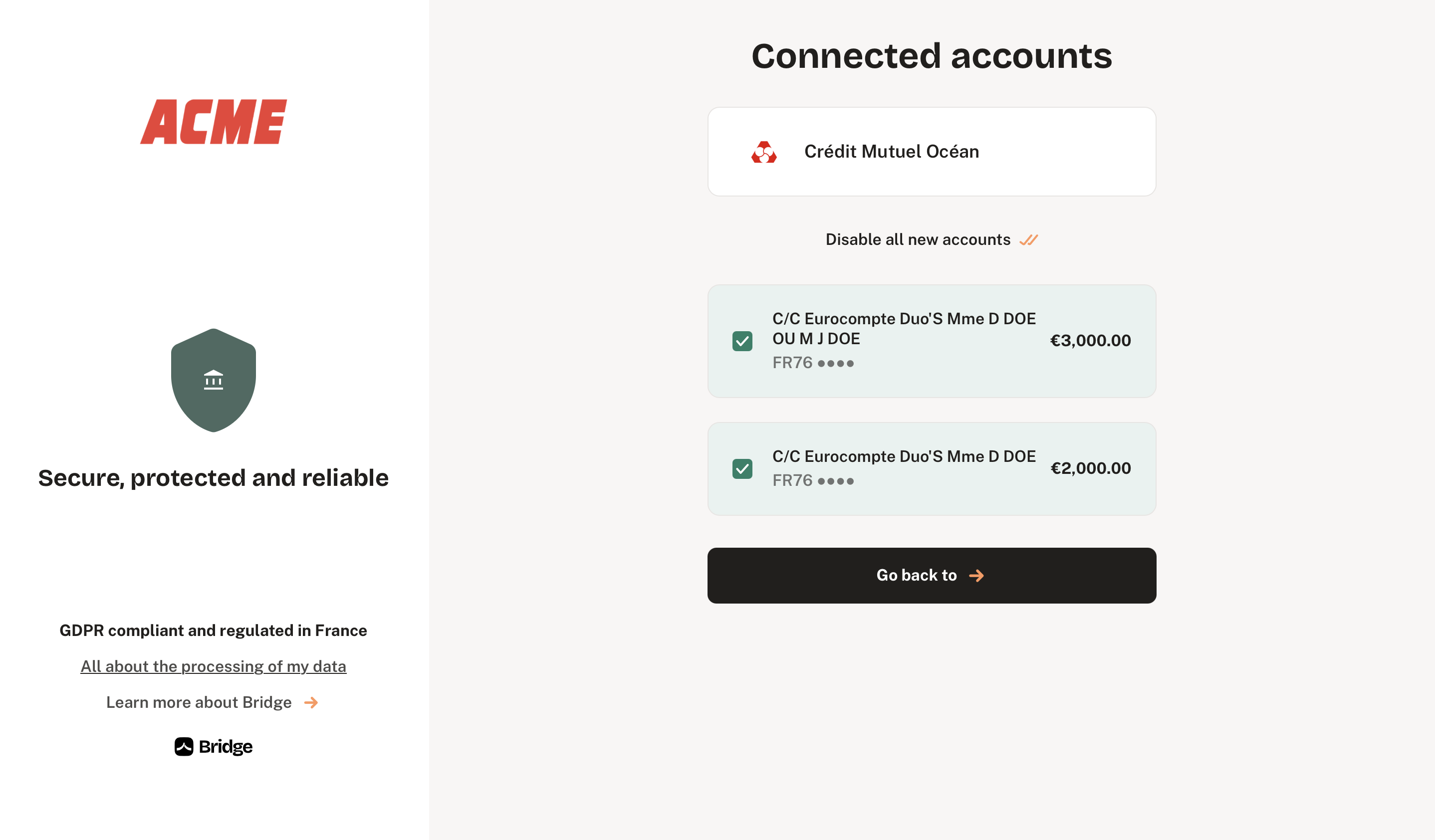

Accounts selection

For each mode, users can exclude specific accounts they do not wish to share with your application.

When an account is excluded, its data_access field will be set to disabled. As a result, you will no longer have access to fetch its transactions, balance, IBAN, or other associated details.

Integration specifications

Provider selection

We recommend you to use our Connect for an optimal end-to-end experience but you can decide to reconstruct the banks list and manage the provider selection step. It implies more effort in integration and fully understand the parent/child relation of the providers.

curl --request GET \

--url https://api.bridgeapi.io/v3/agreggation/connect-sessions/

--header 'accept: application/json'

{

"provider_id": 574

}

{

"id": "bf8f3e2a-6b04-412a-b2a3-be7fef470b4a",

"url": "https://connect.bridgeapi.io/session/09486392-9e19-4045-a758-65daea24aes9"

}Updated 4 months ago